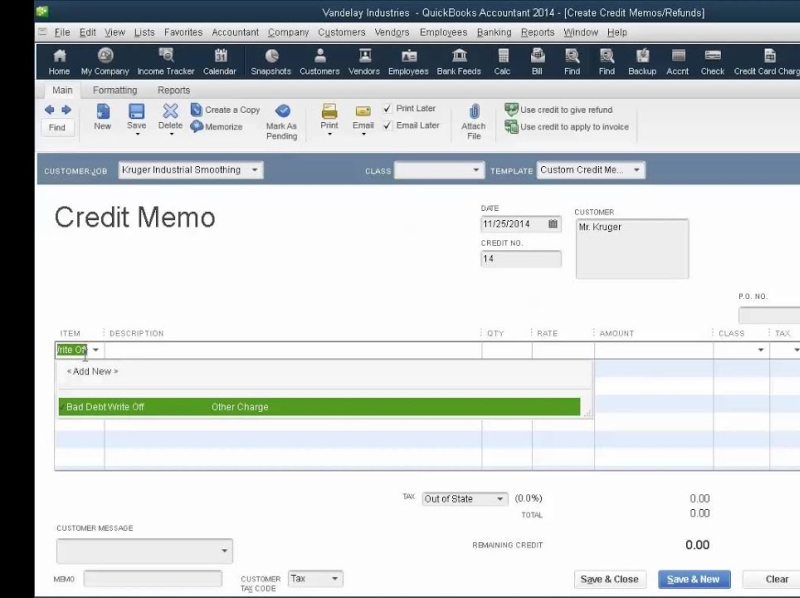

Enter a new account name. To keep things simple, named this something applicable like “Bad Debt” or “Debt Write-Offs”. Select “Save and Close”. At this point, you have added a new expense account to track all bad debt for your business. Now you need to close the unpaid invoices recorded in your QuickBooks account Dec 11, · Write off bad debt in QuickBooks Desktop Step 1: Add an expense account to track the bad debt Go to the Lists menu and select Chart of Accounts. Select the Step 2: Close out the unpaid invoices Jul 10, · Steps to Write Off Bad Debt in QuickBooks. Examine the A/R Aging Report. Create the Bad Debt Account in QuickBooks. Set up a Service / Product Bad Debt Item. Set up a Credit Memo for the Bad Debt. Implement the Credit Memo to Apply for Credits. In blogger.comted Reading Time: 5 mins

How to Write off Bad Debt in QuickBooks - Dancing Numbers

We believe everyone should be able to make financial decisions with confidence. So how do we make money? Our partners compensate us. This may influence which products we review and write about and where those products appear on the sitebut it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Bottom line? QuickBooks is a versatile and flexible software that allows you to accomplish most major accounting tasks whether you have lots of experience or are a first-time business owner doing everything yourself.

With this in mind, the below guide will break down why you should enter loans and write off bad debt using QuickBooks, plus go over how to do both processes in detail. You should enter any loan your business takes how to write off bad debt in quickbooks as a liability in your accounts, plus record the loan payments you make to reduce that liability.

This helps you to keep better track of your business expenses and ensures you can keep your debt payments on track relative to the rest of your business budget. QuickBooks has slightly different loan entering processes depending on whether you use the online or desktop version of the software.

If you want to record loan payments, you can follow these steps for accurate recording:. Entering loans in QuickBooks Desktop is very similar.

However, your business may also use the accrual method of accounting. With accrual method accounting, your business will report any income and expenses for both completed and pending transactions i. QuickBooks allows you to use the accrual method with its versatile tools. If this is the case, you how to write off bad debt in quickbooks write off bad debt as deductions on your taxes in many cases, so you end up owing the federal government less money than you would otherwise.

This helps your net income stay up-to-date and balances your accounts receivable, how to write off bad debt in quickbooks. As with writing loans using QuickBooks, there are two different processes in which to write off debt : one process for desktop users and one for QuickBooks Online users. At this point, you have added a new expense account to track all bad debt for your business.

Now you need to close the unpaid invoices recorded in your QuickBooks account. There you have it! You should create a bad debt expense account as detailed in the desktop version of the process above. For QuickBooks Online, the buttons you need to press should be the same as desktop. Once you have created a bad debts-specific expense account, you can create a new and non-inventory item to be a placeholder for your bad debt.

At this point, how to write off bad debt in quickbooks, you now need to create a credit memo for the bad debt, so it is recorded correctly. Your uncollectible payment receivable should now appear under the Profit and Loss Report for your Bad Debts expense account. Contact us today and see how we can help you accomplish your goals! Topic No. Set up a loan in QuickBooks Online QuickBooks.

Write off bad debt in QuickBooks Desktop QuickBooks. Your email address will not be published. Save my name, email, and website in this browser for the next time I comment. We respect your privacy. privacy policy. If you need to take out a loan for a home improvement project, for school, for starting a business, or for any other reason, you'll have to decide between a secured vs unsecured loan.

While both of these loans can How to write off bad debt in quickbooks More. Almost everyone will take out at least one loan in their life, and most business owners have to take out at least one business loan to pay for property purchases, equipment, and more. Loans allow you to get the cash Whether you're a small business owner looking for a small business loan or looking to make a sizable personal purchase, you may be considering taking out a loan.

Loans provide a way for people to pay for things that they Seek Knowledge Tap into great ideas from the team at Seek Capital. Startup Business Loans Small Business Loans Truck Loans. Loans and Write-Offs in QuickBooks. By Roy Ferman May 18, Loans 6 min read Advertiser Disclosure You're our first priority.

Every time. Why Enter Loans in QuickBooks? Choose which ones you want to write off You should create a bad debt expense account as detailed in the desktop version of the process above.

Sources: Topic No. gov Set up a loan in QuickBooks Online QuickBooks Write off bad debt in QuickBooks Desktop QuickBooks Leave a Reply Cancel reply Your email address will not be published. See Funding Options. Did you learn something from this article? Get more great articles straight to your inbox! Let us make it up to you with better articles straight to your inbox, how to write off bad debt in quickbooks.

What is Defaulting on a Loan and How Does it Work? Everything You Need To Know About Using A Collateral Loan. What Are the SBA Express Loan Requirements?

How To Write Off A Bad Debt In QuickBooks

, time: 4:28Writing off Bad Debts in QuickBooks Desktop – Explained | Scott M. Aber, CPA PC

Jul 10, · Steps to Write Off Bad Debt in QuickBooks. Examine the A/R Aging Report. Create the Bad Debt Account in QuickBooks. Set up a Service / Product Bad Debt Item. Set up a Credit Memo for the Bad Debt. Implement the Credit Memo to Apply for Credits. In blogger.comted Reading Time: 5 mins Enter a new account name. To keep things simple, named this something applicable like “Bad Debt” or “Debt Write-Offs”. Select “Save and Close”. At this point, you have added a new expense account to track all bad debt for your business. Now you need to close the unpaid invoices recorded in your QuickBooks account Dec 11, · Write off bad debt in QuickBooks Desktop Step 1: Add an expense account to track the bad debt Go to the Lists menu and select Chart of Accounts. Select the Step 2: Close out the unpaid invoices

No comments:

Post a Comment